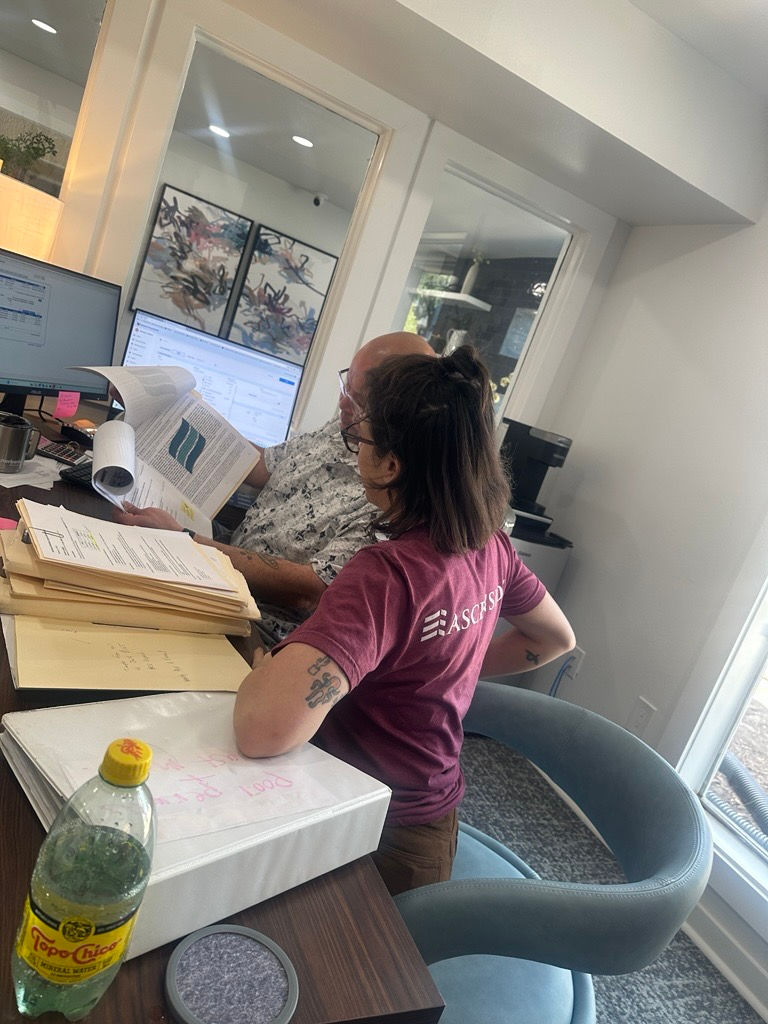

The State of Multifamily in the United States

- Ascension Marketing

- Mar 3, 2023

- 2 min read

The multifamily sector in the United States has been experiencing significant growth in recent years. The demand for rental properties has been driven by a number of factors, including changing demographics, economic trends, and lifestyle preferences. In this blog post, we will explore the current state of multifamily in the United States and some of the key trends driving its growth.

Demographic Shifts

One of the main drivers of the multifamily boom is the changing demographics of the United States. As more people delay marriage and children, the demand for larger, single-family homes has decreased. Additionally, many millennials and Gen Zers are choosing to live in urban areas, where multifamily buildings are more prevalent. This shift in preferences has led to a surge in the construction of multifamily properties in cities across the country.

Economic Trends

The economic climate in the United States has also contributed to the growth of the multifamily sector. As home prices continue to rise, many people are finding it more affordable to rent rather than buy. This is especially true for young adults, who are often burdened with student loan debt and may not have the savings necessary to make a down payment on a home. Additionally, the economic uncertainty caused by the COVID-19 pandemic has made renting a more attractive option for many people.

Lifestyle Preferences

Another factor driving the growth of multifamily is changing lifestyle preferences. Many people are looking for a more flexible, low-maintenance lifestyle that allows them to travel, work remotely, and pursue hobbies and interests. Living in a multifamily property often provides these benefits, as tenants are not responsible for maintenance and repairs and can easily lock up and leave for extended periods of time.

Investment Opportunities

The strong demand for multifamily properties has also made them an attractive investment opportunity for many individuals and institutions. Investors are drawn to the steady income stream provided by rental properties, as well as the potential for long-term appreciation. Additionally, the relative stability of the multifamily sector during economic downturns has made it an appealing option for those seeking to diversify their investment portfolios.

Challenges Facing the Multifamily Sector

Despite the many benefits of the multifamily sector, there are also some challenges facing landlords and property managers. One of the main challenges is the increasing competition for tenants, as more and more buildings are being constructed in urban areas. This can lead to downward pressure on rents and lower occupancy rates. Additionally, landlords must navigate a complex regulatory environment that varies from state to state and can be difficult to navigate.

Conclusion

Overall, the multifamily sector in the United States is in a strong position, driven by changing demographics, economic trends, and lifestyle preferences. While there are certainly challenges facing landlords and property managers, the long-term outlook for the multifamily sector remains positive. As the demand for rental properties continues to grow, we can expect to see continued investment and development in this important segment of the real estate market.

Comments